Steps to Obtain the License

Hereby we would like to specify the services we are to deliver as your service provider for the subject of this engagement, the team we have assigned to the Engagement, how you will remunerate us and other terms of business governing our relationship.

We will be happy to assist you to in applying for a Securities Dealers License in Seychelles. We have substantial experience in this business and we are proficient in executing the application to the Financial Service Authority (FSA) in a manner that will satisfy the regulator. We prefer to prepare all the documents, including the required business plan, by ourselves.

About Seychelles Securities Dealer License

Permitted Activities

1. Primary Equities

2. Primary Debt Instruments

3. Derivative Instruments (futures, options, forwards, contracts, CFDs and Swaps), on any of the following underlying assets; Equities, bonds, metals, commodities, currencies including cryptocurrency.

This definition also includes a person who holds a restricted securities dealer license.

Permitted Securities

1. Primary Equities

2. Primary Debt Instruments

3. Derivative Instruments (futures, options, forwards, contracts, CFDs and Swaps), on any of the following underlying assets; Equities, bonds, metals, commodities, currencies including cryptocurrency.

This definition also includes a person who holds a restricted securities dealer license.

Conditions to a Securities Dealer License

Activities permitted under the Securities Dealer License are only those that are contained within the license and are limited to only such business as stated. The Securities Dealer must comply with the conditions contained in its license.

The Authority may impose conditions on a licensee which includes:

• Limiting the nature and scope of the business carried on by the licensee, including the type of securities that may be dealt with by the Securities Dealer.

• Specifying whether or not the Securities Dealer may hold client’s assets

• Requiring the Securities Dealer or senior officer or manager of the licensee to acquire and maintain membership of a recognized overseas securities exchange.

Seychelles Securities Dealer License Exemptions

An application for exemption from the requirement to obtain a securities dealer license may be submitted by a securities dealer, licensed under the laws of a Recognized Jurisdiction that meets the requirements of section 45(1) (b)

To qualify for an Exemption the applicant must:

• Be a member of a recognized overseas securities exchange and a Seychelles Securities Exchange

• Be in good standing and hold a current license or other authorization to deal in securities under the laws of a recognized jurisdiction

When dealing with an application The Authority will not grant a license unless it is satisfied that the applicant:

The licensee will need at least 2 (two) natural person Directors of any jurisdiction who will Satisfy the SecuritiesAuthority that they are fit and proper persons to be licensed as a dealer.

The licensee will need at least 2 shareholders and a corporate shareholding is allowed.

The current prescribed minimum issued and paid up capital required is US$ 50,000.

The Securities Authority shall not grant a Securities Dealer’s License unless the applicant employs at least one individual who is licensed as a representative under section 52 of the Act. A Securities Dealer’s Representative means an individual in the employment of (including a Director of), or acting on behalf of or by arrangement with a securities dealer, who deals in securities on behalf of that securities dealer, whether he is paid salary, wages, commission or otherwise.

Activities permitted under the Securities Dealer License are only those that are contained within the license and are limited to only such business as stated. The Securities Dealer must comply with the conditions contained in its license.

The Authority may impose conditions on a licensee which includes:

• Limiting the nature and scope of the business carried on by the licensee, including the type of securities that may be dealt with by the Securities Dealer.

• Specifying whether or not the Securities Dealer may hold client’s assets

• Requiring the Securities Dealer or senior officer or manager of the licensee to acquire and maintain membership of a recognized overseas securities exchange.

An application for exemption from the requirement to obtain a securities dealer license may be submitted by a securities dealer, licensed under the laws of a Recognized Jurisdiction that meets the requirements of section 45(1) (b)

To qualify for an Exemption the applicant must:

• Be a member of a recognized overseas securities exchange and a Seychelles Securities Exchange

• Be in good standing and hold a current license or other authorization to deal in securities under the laws of a recognized jurisdiction

When dealing with an application The Authority will not grant a license unless it is satisfied that the applicant:

The licensee will need at least 2 (two) natural person Directors of any jurisdiction who will Satisfy the Securities Authority that they are fit and proper persons to be licensed as a dealer.

The licensee will need at least 2 shareholders and a corporate shareholding is allowed.

The current prescribed minimum issued and paid up capital required is US$ 50,000.

The Securities Authority shall not grant a Securities Dealer’s License unless the applicant employs at least one individual who is licensed as a representative under section 52 of the Act. A Securities Dealer’s Representative means an individual in the employment of (including a Director of), or acting on behalf of or by arrangement with a securities dealer, who deals in securities on behalf of that securities dealer, whether he is paid salary, wages, commission or otherwise.

During the incorporation process we can start and arrange the application and the business plan that will be submitted to the FSA. Application preparation on our side takes 2-4 weeks. We will need you to provide us with the following documents for each shareholder and director:

‣ Certified passport copy

‣ Certified utility bill in English issued within the last month

- CV (Curriculum Vitae)

‣ Certified academic and professional certificates (if any)

‣ Two professional reference letters

‣ Bank reference letter

‣ Employment Letter from current employer (if applicable)

‣ Police Criminal Certificate (not older than 3 months)

‣ Tax Compliance Certificate (recent) from the place where Directors/Shareholders currently reside or are citizens

‣ Passport photos (two, certified at the back as “true likeness”)

‣ Proof of source of funds for the Shareholder (bank statement showing at least US$50,000 in deposit)

A Securities Dealer is required to have its accounts audited annually by an auditor. The Auditor has to be a member and in good standing of an accountancy body in compliance with section 2(1)(a) of the Act or a member of any other accountancy body as approved by the Authority. The licensee must appoint is Auditor within 30 days of becoming licensed under the Act, who is acceptable to the Securities Authority. A Director, Officer, Employee, Shareholder or Partner of the licensee or a partner or employee of such a person shall not be eligible for appointment as an auditor.

A licensed securities dealer must have its accounts audited annually according to the International Financial Reporting Standards. Both a licensed securities dealer and an exempt securities dealer must submit to the Authority its audited accounts within 4 months of the end of each financial year or within such extension period allowed by the Authority.

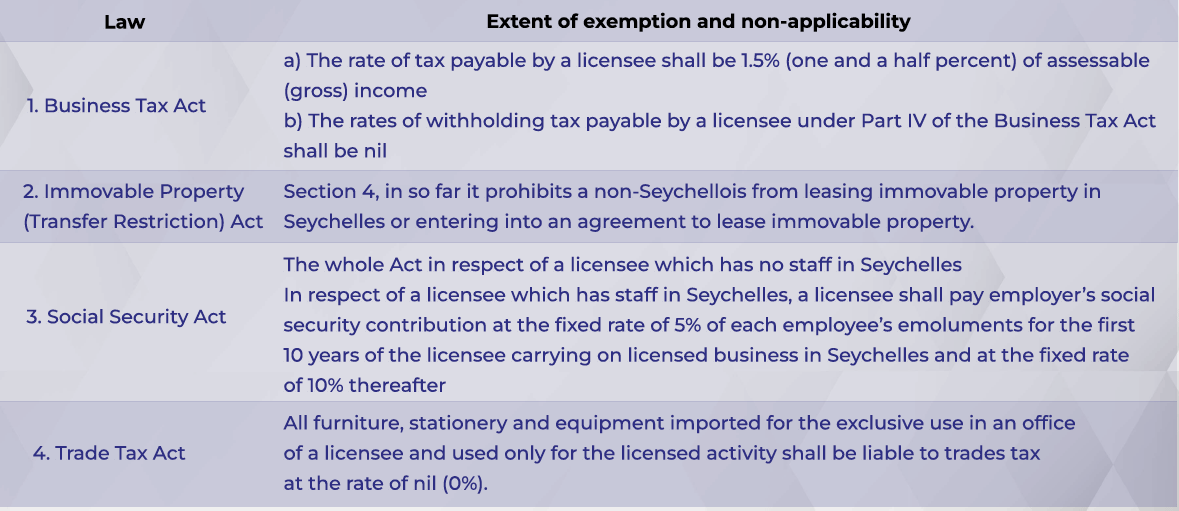

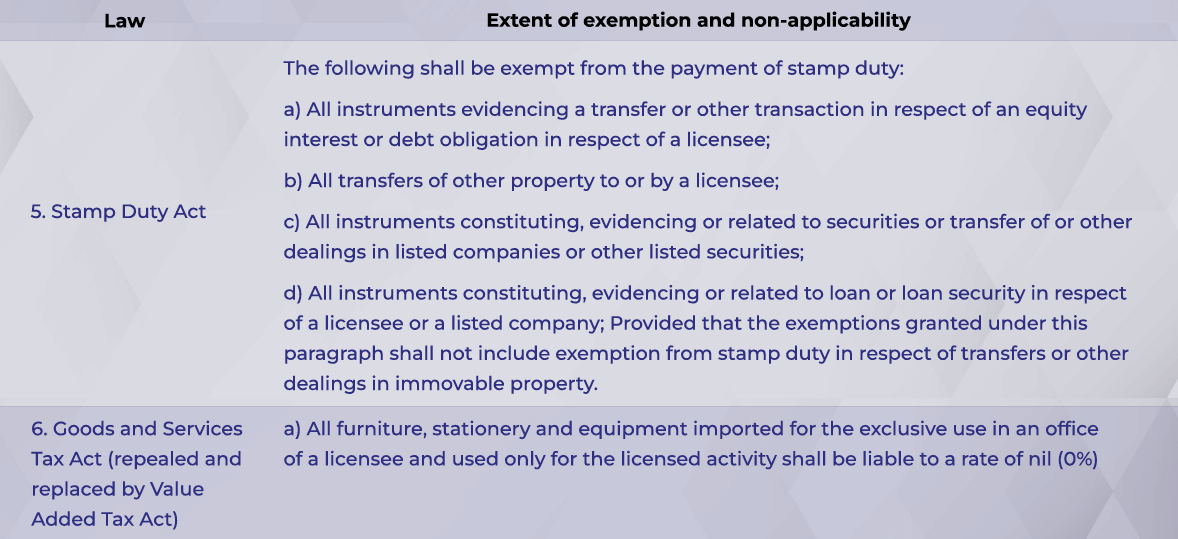

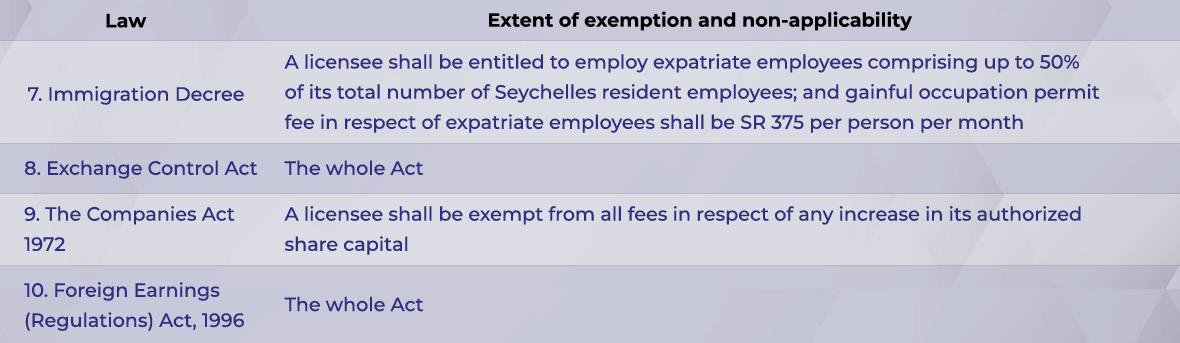

Schedule 3 of the Act grants exemptions and concessions from the applicability of certain legislative enactments.

An application submitted to the Authority for a Securities Dealers License must comprise of the following documents:

a) A completed Application Form

b) The relevant application fee

c) Certified true copies of the constitutional documents of the applicant (Memorandum and Articles of Association, Certificate of Incorporation, Certificate of good standing)

d) The audited financial statements of the applicant for the last 2 years, if the applicant was not incorporated within the last 12 months

e) Personal Questionnaire Form completed by each director, senior officer, individual shareholder and beneficial owner of the applicant (if the relevant party is listed on a stock exchange in a recognised jurisdiction, Personal Questionnaire Forms are not required)

f) The last audited financial statements of the controlling owners of the applicant if the controlling owner is a nonindividual

g) The Representative License Application Form

h) Notice of place at which the Register of Securities is to be kept as per Section 80(2)(a) of the Securities Act, 2007 and Schedule 1, Form 6 of the Securities (Forms and Fees) Regulations, 2008

i) A written notification from the representative in accordance with section 53 of the Securities Act, 2007

j) A copy of the policy of insurance (appropriate to the proposed nature and size of the business) of the applicant

k) Director’s and Shareholder’s KYC

1. Curriculum Vitae of each director and shareholder;

2. Bank reference for each director and shareholder;

3. Passport Copy and Proof of address for each director and shareholder;

4. Police Criminal Certificate

5. Tax Certificate

6. Employment Reference

7. Academic Qualifications

The applicant also has to include the details of the following upon making the application:

a) Auditors or proposed Auditors

b) Lawyers or proposed Lawyers

c) Bankers or proposed Bankers

Phase I – Collection of Information

The main aspects of this phase are:

1. Due diligence and KYC checks.

2. Name check at the Registrar of Companies

Phase II – Preparing Application Forms, Drafting and Compiling Documentation & Reviewing of Application

At this stage we will be:

1. Preparing the license application pack

2. Incorporating the company

Phase III – Filing Application with the Seychelles Financial Services Authority (FSA) Once the application is ready, we will file it with the FSA together with the requisite fees.

Phase IV – Follow up and liaising with FSA

We will then follow up with FSA, attend to any queries until the outcome of the application is given by FSA.

Duration for Set up: Approximately 3 months

Looking for help? Get in touch with us